Marcus Freeman Wife - Financial Comfort And Peace Of Mind

For anyone trying to keep their household finances in good shape, or just looking for a bit more calm in their daily lives, the idea of having money matters settled can bring a lot of comfort. We often think about famous people, like the family of a public figure, and wonder what their daily routines might involve. It's almost, you know, a natural thing to consider how they manage the regular stuff, like making sure their savings are in a sensible spot, or what helps them feel steady when things get a bit wobbly.

When it comes to personal finance, there are quite a few options out there for putting your money somewhere it can grow a little. You see, places like Marcus, for instance, tend to adjust their interest rates pretty quickly when the main financial institutions make changes. Then again, some other savings options, like Affirm savings, have apparently stayed pretty much the same over the past few years, which is interesting to note.

This whole conversation around where to keep your money, and how that affects your peace of mind, is something many people think about. It’s not just about the numbers; it’s about feeling secure and having things sorted. So, whether you are thinking about how a prominent family, perhaps like Marcus Freeman's wife's, might approach their finances, or just looking for ways to feel more at ease yourself, these are the kinds of thoughts that often come up.

Table of Contents

- What Does Financial Stability Mean for a Household, say, like Marcus Freeman's Wife's?

- Choosing a Good Home for Your Money

- Are All Savings Options the Same for Marcus Freeman's Wife?

- Moving Money Around - What to Keep in Mind

- The Comfort of Familiar Names for Marcus Freeman's Wife

- Beyond the Numbers - Personal Well-being

- How Do Life's Challenges Affect Us, and Perhaps Marcus Freeman's Wife Too?

- Finding Support and Understanding

- When Stories Don't Quite Line Up

What Does Financial Stability Mean for a Household, say, like Marcus Freeman's Wife's?

Having a good handle on your money can bring a great deal of calm to daily life. It’s about more than just having enough; it’s about knowing your funds are in a safe spot and working for you. Marcus, as a financial choice, is often seen as a pretty solid pick. You see, your money there is protected by the government’s insurance program, which is a big deal, and they tend to offer decent rates, which is pretty nice. This kind of setup can offer a feeling of quiet reassurance, which is something anyone, including perhaps Marcus Freeman's wife, would value for their family's financial peace.

There are other places you could also consider for keeping your savings, too. You might look at Ally, or maybe Capital One, or even Discover. These are just a few of the choices out there for accounts that give you a better return on your money than a regular bank account. The main idea, really, is that getting some interest on your savings is a smart move. It means your money isn't just sitting there; it's doing a little bit of work for you, which is a good thing.

When you're picking a spot for your savings, it's often a balance between getting the absolute best interest rate and feeling comfortable with the name behind the account. Marcus, for example, is a good, reliable choice for an online savings account that offers a better yield than many traditional banks. But, you know, sometimes you might give up a tiny bit of that higher return for the comfort that comes with a brand you recognize and trust. This is apparently also the case for savings accounts with American Express, which many people find pretty familiar.

Choosing a Good Home for Your Money

Many people, when they're thinking about where to put their extra funds, are looking for something that feels secure and dependable. They want a place where their money can grow a bit without too much fuss. So, if you're trying to avoid the newer, less established financial tech companies and just want to stick with well-known banks, there are definitely good options. I mean, some folks are very happy with their more traditional savings setups, and they often find that these accounts also let you add different features or services, which is quite helpful.

It's interesting to consider that for someone like Marcus Freeman's wife, making these financial decisions would probably involve similar thoughts. They would likely weigh the benefits of a slightly higher rate against the peace of mind that comes from a long-standing, trusted institution. The goal is always to find a balance that works for your own situation, making sure your money is both safe and productive, which is a pretty common aim for anyone managing a household budget.

The truth about these financial choices is that you don't have to fully relate to every detail for the core message to resonate. The idea of seeking stability and growth for your money is pretty universal. Whether you're managing a family budget, or just trying to build up your own personal savings, the principles of finding a good, solid option for your funds are more or less the same, and these choices can certainly make a real difference in how settled you feel about your financial future.

Are All Savings Options the Same for Marcus Freeman's Wife?

When you start looking closely at different savings accounts, you quickly see that they're not all built the same. For instance, the way money moves in and out of an account can be quite different depending on where you bank. With Marcus, if you need to take money out and send it somewhere else, it's typically an ACH transfer. This kind of transfer is a bit like sending a check; it takes a little longer to process and get where it needs to go, which is something to remember.

Apparently, a common misstep people make is thinking that a transfer out of Marcus would be a wire transfer, which happens much quicker. But, you know, that's not how it works there, and expecting it to be a wire could lead to some frustration. It’s just a simple difference in how the banks handle moving funds, but it can certainly feel like a big deal if you're expecting something faster, and it doesn't happen that way.

So, for someone like Marcus Freeman's wife, who might be managing family funds, understanding these small but important details about how different banks operate is pretty key. Knowing whether a transfer is an ACH or a wire can really affect your planning, especially if you need access to funds by a certain time. It's these kinds of practical bits of knowledge that really help in making the best choices for your money, and for your family's overall financial comfort.

Moving Money Around - What to Keep in Mind

Let's talk about moving larger sums of money around, because that's something many people consider, especially when they're trying to get their savings to work harder. For example, someone might have a good amount of money, say, $140,000, sitting in a regular checking account at a place like Chase. They might then think about putting a significant portion of that, maybe $110,000, into a high-yield savings account, perhaps with Marcus, to earn more interest. It's almost, you know, a common scenario for those looking to optimize their funds.

Based on the interest rates, you could expect to get a decent amount of money each month from that kind of sum, perhaps around $215. For some, that might seem a little too good to be true, and it's understandable to feel that way. It really highlights how much of a difference moving money to a high-yield account can make compared to letting it sit in a checking account that earns very little, if anything at all. This kind of careful planning is a big part of managing personal finances effectively.

When you are looking to open a high-yield savings account, there are quite a few choices to consider. You might find yourself weighing options like Marcus versus Capital One 365, or perhaps American Express versus Barclays. Each one has its own features and rates, and it's about finding the one that fits your particular needs and comfort level. The main thing is to make an informed choice that helps your money grow, which is what many people, including perhaps Marcus Freeman's wife, would be looking for in their financial arrangements.

The Comfort of Familiar Names for Marcus Freeman's Wife

There's a real sense of calm that comes with sticking to financial institutions you know and trust. For instance, having a checking account with a long-standing bank like Chase and a savings account with a familiar name like Marcus by Goldman Sachs, gives many people a feeling of security. It's like having your money spread out but still within a circle of trusted names, which can be very reassuring, you know, for anyone managing family finances, including perhaps Marcus Freeman's wife.

The desire to avoid newer, less established financial technology companies and simply stick with traditional banks is pretty common. People often value the stability and history that comes with these institutions. They feel more comfortable knowing their money is with a company that has been around for a long time and has a solid reputation, and that's a perfectly valid preference when it comes to something as important as your savings.

This preference for familiar names often means that even if a new, smaller company offers a slightly higher interest rate, the comfort of a known brand wins out. It's a trade-off many are willing to make for that added peace of mind. So, while the numbers are important, the feeling of security and reliability that comes from a trusted name is also a very big factor in where people decide to keep their hard-earned money, which is a sensible approach.

Beyond the Numbers - Personal Well-being

It's interesting how much our personal experiences, even those not directly related to money, can shape our outlook on life and security. Sometimes, the deeper truths about life's struggles don't require you to have lived through the exact same thing for them to really hit home. You see, even if you don't fully relate to every single detail of someone else's experience, the raw feeling or the core message can still resonate quite strongly with you, which is pretty powerful.

For instance, someone might have gone through a period of minor depression, or perhaps they've watched a close family member, like their dad, go through it. These kinds of experiences, though deeply personal, teach you a lot about resilience and the importance of support. They show you that life has its ups and downs, and that looking after your mental well-being is just as important as looking after your financial health, which is a very real aspect of life.

These personal challenges can influence how someone views stability, both emotional and financial. It’s all connected, really. A sense of security in one area can often help in another. So, when we think about the broader picture of well-being, it's clear that it's not just about what's in the bank account, but also about how we handle the less tangible parts of life, which is a big part of feeling settled and comfortable.

How Do Life's Challenges Affect Us, and Perhaps Marcus Freeman's Wife Too?

Life has a way of throwing unexpected things our way, and how we deal with them can shape our perspectives quite a bit. Sometimes, these challenges are very personal, like dealing with a period of low spirits or seeing a loved one struggle. These experiences, while tough, can also teach us about the importance of being prepared, not just financially, but emotionally, too. It’s almost like building up a different kind of savings account, one for resilience and understanding.

It makes you think about how anyone, including perhaps Marcus Freeman's wife, might navigate the personal side of things while also managing the public eye. The truth is, everyone faces their own set of difficulties, and having a good support system, whether it’s for financial advice or emotional comfort, is incredibly helpful. These personal journeys, while private, often highlight universal themes of strength and perseverance, which is quite inspiring.

The idea that you don't have to fully experience something to understand its impact is very true. We can learn a lot from observing others and from reflecting on our own smaller struggles. This kind of empathy and broader view helps us appreciate the full picture of well-being, which is about more than just the visible aspects of life. It’s about feeling secure and supported in every way possible, which is a pretty fundamental human need.

Finding Support and Understanding

When people go through tough times, whether it's a minor dip in their mood or something more serious, finding support is really important. It’s about having someone to talk to, or knowing there are resources available that can help. This kind of support system is crucial for anyone, and it’s something that can help maintain a sense of balance, even when things feel a bit uncertain. It’s just a little bit of extra help when you need it most, you know.

These experiences, even if they are personal and not widely known, shape a person’s outlook. They teach you about what truly matters and the value of having a safety net, whether that net is made of close relationships or sound financial planning. It’s all part of building a life where you feel more prepared for whatever comes your way, which is a pretty sensible goal for anyone, including perhaps Marcus Freeman's wife, who juggles many responsibilities.

So, when we consider the full scope of well-being, it's clear that emotional and mental health are just as important as having a stable bank account. They work together to create a sense of overall security and peace. The ability to find and accept help, or to simply have a safe space to process things, is a significant part of staying strong and resilient through life's various challenges, which is a very human experience.

When Stories Don't Quite Line Up

Sometimes, in life, you come across stories or accounts where something just doesn't sit right with you. It’s like when you hear a story, perhaps about a military event, and you find yourself questioning certain parts of it. For instance, some people might not believe a word of a particular account, like Marcus Luttrell’s description of the Red Wings mission. They might have reasons for their doubts, and accusations about the story's accuracy might have been made, which is something that happens.

When these kinds of doubts pop up, it’s natural to want to hear the other side, or to see if there are any good arguments that counter the claims. It's about seeking clarity and trying to understand the full picture, which is a pretty common human desire. This quest for truth, whether it's about a historical event or a personal narrative, is a fundamental part of how we make sense of the world around us, and it shows a healthy sense of inquiry.

This kind of critical thinking applies to many areas of life, not just big public stories. It's about being discerning and not just accepting things at face value. So, whether it's understanding the nuances of a financial transfer or questioning a widely told story, the ability to think critically and seek out different perspectives is a valuable trait, and it’s something that can help anyone, including perhaps Marcus Freeman's wife, in their daily considerations.

The article has explored various aspects of financial management, from choosing savings accounts like Marcus, Ally, Capital One, Discover, Amex, and Barclays, to understanding transfer types like ACH versus wire. It discussed the comfort of familiar banking brands and the pursuit of competitive interest rates, illustrating with personal examples of managing significant sums of money. Additionally, the article touched upon personal well-being, reflecting on experiences with minor depression and the importance of support, and also considered the nature of belief when faced with conflicting accounts, emphasizing the human need for clarity and understanding.

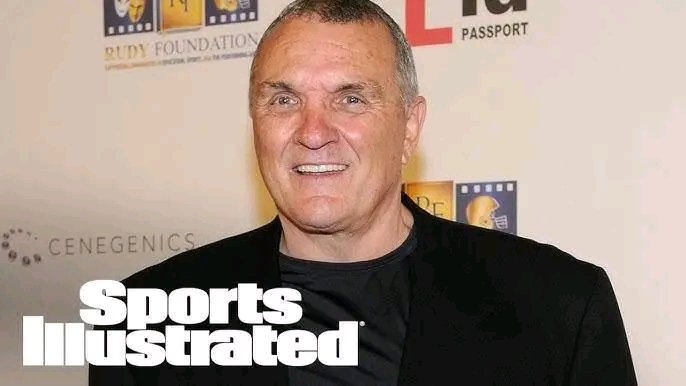

💔 SAD NEWS: Notre Dame Fighting Irish head football coach….

💔 SAD NEWS: Notre Dame Fighting Irish head football coach….

💔 SAD NEWS: Notre Dame Fighting Irish head football coach….